RWA Tokenization Platforms in DeFi: Transforming Real-World Assets into Digital Liquidity

Introduction

In recent years, RWA tokenization platforms in DeFi have revolutionized the way physical and financial assets are represented on blockchain networks. Real-World Asset (RWA) tokenization bridges the gap between traditional finance (TradFi) and decentralized finance (DeFi), enabling tangible assets such as real estate, bonds, commodities, and invoices to exist as blockchain-based tokens. This integration creates a seamless pathway for liquidity, transparency, and accessibility within DeFi ecosystems.

As institutional interest grows, RWA tokenization is emerging as the next major evolution of decentralized finance. These platforms are reshaping lending, asset management, and yield generation by transforming illiquid assets into tradeable digital tokens. This fusion of physical value and blockchain efficiency is driving the next wave of financial innovation.

What Are RWA Tokenization Platforms in DeFi?

RWA tokenization platforms convert ownership rights of real-world assets into digital tokens that can be traded or used as collateral on DeFi protocols. Each token represents a verified share of the asset, backed by real-world value.

This process involves four key stages:

-

Asset Selection and Legal Structuring: Choosing eligible real-world assets and defining their legal ownership frameworks.

-

Tokenization: Digitizing asset ownership into blockchain-based tokens.

-

Integration into DeFi Ecosystems: Enabling trading, lending, and yield generation.

-

Regulatory Compliance: Ensuring adherence to jurisdictional and KYC/AML standards.

Platforms such as Centrifuge, MakerDAO, and Ondo Finance are leading this transformation by integrating RWA-backed tokens into decentralized markets.

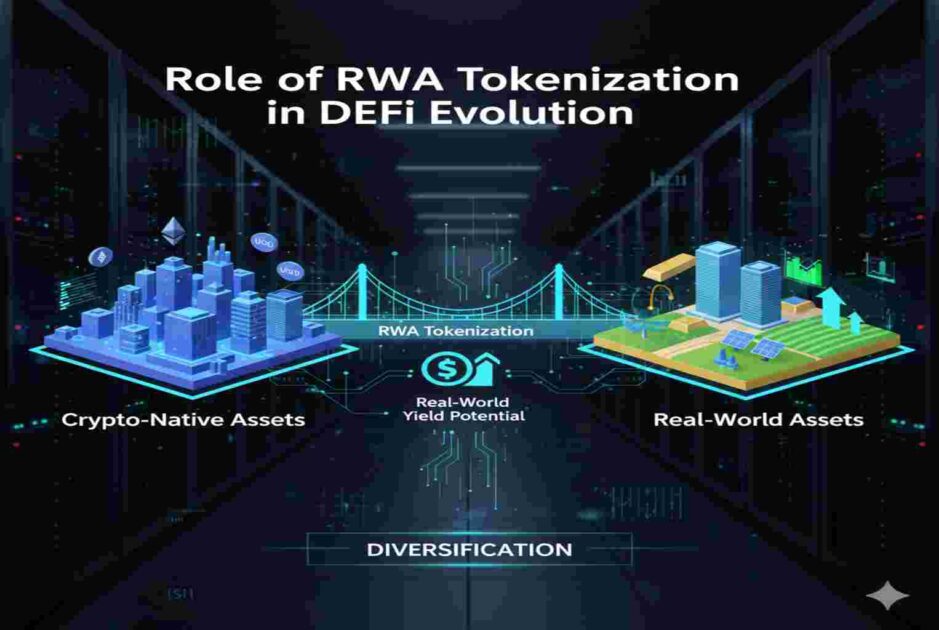

The Role of RWA Tokenization in DeFi Evolution

DeFi initially thrived on crypto-native assets like Ethereum and stablecoins. However, this ecosystem lacked exposure to stable, yield-generating real-world assets. RWA tokenization platforms in DeFi solve this by introducing diversification and real-world yield potential.

For instance, MakerDAO has integrated tokenized U.S. Treasury bonds to back its DAI stablecoin, enabling a more sustainable and low-volatility collateral base. Similarly, Centrifuge allows businesses to tokenize invoices and use them as collateral for decentralized loans.

This integration enhances DeFi’s long-term stability while attracting institutional liquidity.

Key Advantages of RWA Tokenization Platforms in DeFi

1. Increased Liquidity for Illiquid Assets

By converting physical assets into tradable tokens, tokenization unlocks liquidity in traditionally illiquid markets such as real estate, bonds, and art.

2. Enhanced Transparency and Traceability

Blockchain-based ownership records improve transparency in valuation, transactions, and asset provenance.

3. Democratized Access to Investment Opportunities

Retail and institutional investors can now access fractional ownership of high-value assets globally without intermediaries.

4. Yield Generation and Capital Efficiency

Tokenized RWAs can be staked, lent, or pooled to earn yields—creating new avenues for passive income.

5. Improved Risk Diversification

Exposure to multiple asset classes reduces dependence on volatile crypto assets and enhances DeFi portfolio resilience.

Top RWA Tokenization Platforms in DeFi (2025)

1. Centrifuge: Centrifuge enables businesses to tokenize invoices and access liquidity through its Tinlake protocol. It connects real-world financing to DeFi liquidity pools, reducing reliance on centralized intermediaries.

2. MakerDAO: MakerDAO is integrating U.S. Treasury bills and short-term bonds as collateral, blending stable real-world yields with decentralized governance.

3. Ondo Finance: Ondo provides tokenized U.S. Treasuries and corporate bonds, offering investors access to regulated yield-bearing instruments on-chain.

4. Maple Finance: Maple Finance bridges institutional credit markets and DeFi by offering tokenized debt instruments and on-chain lending pools.

5. Goldfinch Protocol: Goldfinch specializes in under-collateralized lending backed by real-world business operations, making it essential for emerging market finance.

6. RealT: RealT fractionalizes real estate ownership into Ethereum-based tokens, enabling global access to property investments.

7. Securitize: Securitize focuses on tokenized securities, providing regulated infrastructure for RWA token issuance and secondary trading.

8. Clearpool: Clearpool connects institutional borrowers and DeFi lenders through tokenized credit products.

How RWA Tokenization Platforms in DeFi Work

Step 1: Asset Verification and Legal Structuring

Every asset undergoes verification, including valuation, documentation, and compliance checks. A legal framework defines the ownership rights tied to the token.

Step 2: Token Creation

Each token represents a specific fraction of the asset. Smart contracts govern these tokens’ transferability, ownership, and yield distribution.

Step 3: DeFi Integration

The tokens are then deposited into DeFi protocols such as Aave, Compound, or MakerDAO, where they can generate yield, be used as collateral, or traded in liquidity pools.

Step 4: Redemption or Secondary Trading

Investors can redeem tokens for the underlying assets or trade them on secondary DeFi markets, maintaining liquidity and flexibility.

Regulatory Framework for RWA Tokenization in DeFi

Legal clarity is a critical challenge. Since RWAs represent tangible assets, compliance with securities laws, KYC/AML standards, and jurisdictional requirements is essential.

Platforms like Securitize and Ondo Finance have adopted regulatory-compliant structures by partnering with licensed custodians and regulators.

Governments and blockchain firms are also exploring frameworks for Digital Asset Securities and Tokenized Bonds, ensuring investor protection while promoting innovation.

For deeper insight into compliance and legal perspectives, see Crypto Lending Protocols, which discusses the integration of regulation and innovation in DeFi lending.

Integration of RWA Tokenization with DeFi Protocols

1. Collateralization in DeFi Lending

RWA tokens can serve as collateral for decentralized lending protocols, enhancing liquidity and stability.

2. Yield Farming with Tokenized RWAs

Protocols like Fluid DeFi (explained in Fluid DeFi Protocol) demonstrate how yield optimization can extend to real-world tokenized assets.

3. Decentralized Governance

Token holders participate in governance decisions, voting on collateral onboarding, yield rates, and protocol upgrades—similar to Polkadot governance mechanisms explained here.

RWA Tokenization Platforms and Institutional Adoption

Institutional participation is accelerating as traditional finance seeks blockchain exposure without volatility risks. Galaxy Digital and Grayscale Investments are exploring partnerships with RWA-focused DeFi protocols to integrate tokenized bonds and funds.

To explore institutional strategies, refer to Galaxy Digital: Bridging Crypto and Traditional Finance and Grayscale Investments: Leading Institutional Crypto Access.

Challenges Facing RWA Tokenization Platforms in DeFi

1. Regulatory Fragmentation

Different jurisdictions interpret digital assets differently, complicating global operations.

2. Valuation and Audit Complexity

Ensuring the accuracy of off-chain asset valuations remains difficult.

3. Custody and Counterparty Risks

Physical asset custody requires trusted intermediaries, which may reintroduce centralization risks.

4. Technological Integration

Cross-chain communication and interoperability remain crucial for scaling tokenized RWA ecosystems.

For more on interoperability, visit Cross-Chain Interoperability: Seamless Crypto Transfers.

The Future of RWA Tokenization Platforms in DeFi

As blockchain evolves, RWA tokenization will expand beyond institutional finance to include supply chain assets, intellectual property, carbon credits, and real estate derivatives.

Advancements in Layer 3 blockchain scalability (see Layer 3 Blockchain Scalability Solutions) and AI-integrated DeFi systems will make RWA tokenization faster, more secure, and globally accessible.

In 2025 and beyond, these platforms will serve as the backbone of an interconnected financial web where every real-world value can be tokenized, fractionalized, and traded seamlessly across decentralized markets.

Conclusion

RWA tokenization platforms in DeFi are redefining the boundaries of financial innovation. By linking real-world assets to blockchain networks, they enable global liquidity, transparency, and inclusivity. Despite regulatory and technical challenges, the growing institutional adoption signals a massive transformation ahead.

As DeFi matures, the convergence of real-world finance and blockchain technology will become inevitable—ushering in a new era of digital liquidity and financial democratization.

Top 10 FAQs about RWA Tokenization Platforms in DeFi

1. What are RWA tokenization platforms in DeFi?

They are blockchain-based platforms that convert real-world assets into tradable digital tokens for use in DeFi ecosystems.

2. Which assets can be tokenized?

Assets like real estate, invoices, bonds, carbon credits, and commodities can all be tokenized.

3. How do RWA tokens generate yield?

They can be lent, staked, or traded in DeFi protocols to earn passive income.

4. What role does regulation play in RWA tokenization?

Compliance ensures that tokenized assets remain legally valid and protect investor interests.

5. Are RWA tokens stable compared to crypto assets?

Yes, they derive value from tangible assets, making them more stable than volatile cryptocurrencies.

6. How are investors protected in RWA platforms?

Smart contracts, audits, and legal frameworks safeguard token ownership and transactions.

7. Which DeFi protocols currently use RWA tokens?

MakerDAO, Centrifuge, Ondo Finance, and Maple Finance are major players.

8. What are the risks of investing in RWA tokens?

Risks include valuation discrepancies, legal uncertainty, and counterparty risks.

9. Can RWA tokens improve DeFi scalability?

Yes, tokenized assets expand the asset base, stabilizing liquidity and scaling yield markets.

10. What is the long-term future of RWA tokenization?

It will become the foundation for hybrid financial systems combining TradFi and DeFi globally.