The concept of real-world asset (RWA) tokenization in blockchain is quickly becoming one of the most promising innovations in the crypto space. As decentralized finance (DeFi) evolves beyond speculative trading, tokenizing real-world assets like real estate, commodities, or invoices is bridging traditional finance and blockchain technology.

What is RWA tokenization?

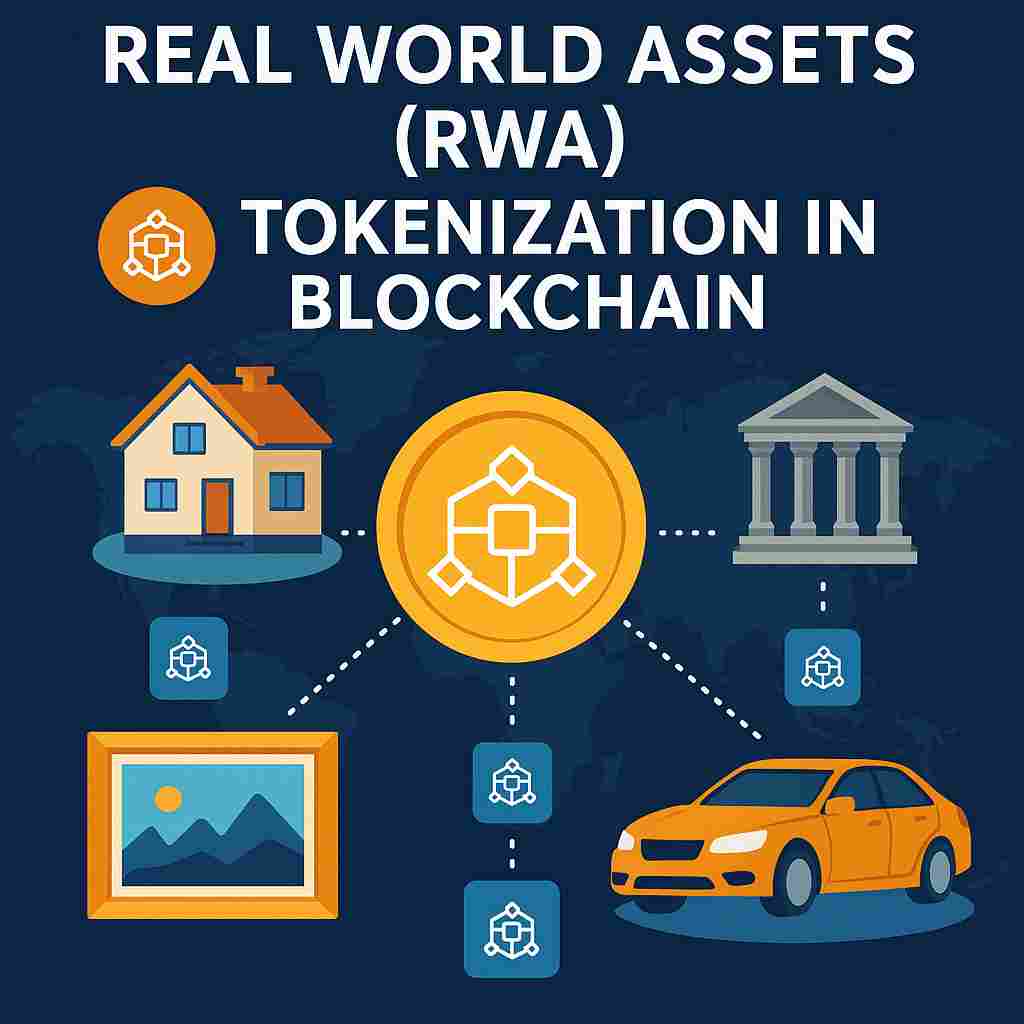

RWA tokenization is the process of converting physical or off-chain assets into digital tokens on a blockchain. These tokens represent ownership rights or shares in the underlying assets, making it easier to transfer, divide, and trade them in a secure, transparent, and immutable environment.

Why RWA Tokenization Matters in 2025

With rising institutional interest and growing regulatory clarity, 2025 is shaping up to be a pivotal year for tokenized real-world assets. Several factors are accelerating the adoption:

- Improved blockchain scalability (learn more in Proto-Danksharding Explained)

- Enhanced interoperability between chains

- Stablecoin and CBDC integration

- DeFi protocols supporting RWA lending and yield farming (Explore RWA Yield Farming)

Types of Tokenized Real-World Assets

- Real Estate—Property ownership represented as fractional NFTs or security tokens.

- Commodities—gold, oil, or agricultural products—tokenized for easier global trading.

- Equities and Bonds—Traditional financial securities digitized for borderless access.

- Invoices and Loans—Enabling real-time liquidity for businesses.

- Art and Collectibles—Ensuring Provenance and Facilitating Investment.

Benefits of RWA Tokenization

- Liquidity for Illiquid Assets: Makes it possible to trade shares of assets that traditionally lack liquidity.

- Fractional Ownership: Reduces investment barriers, allowing broader participation.

- Transparency and Security: Ensures clear ownership records and reduces fraud.

- 24/7 Global Access: Open markets that never close, powered by decentralized platforms.

Projects Leading the RWA Revolution

- Centrifuge: Focuses on tokenizing real-world assets for DeFi liquidity.

- Maple Finance: Facilitates under-collateralized lending using RWAs.

- Ondo Finance: Tokenizes bonds and treasuries to bring traditional yields into DeFi.

As RWA projects gain traction, they are also aligning with other high-growth trends in crypto. For example, platforms exploring high-risk, high-reward crypto coins (read here) and new coins with high ROI (explore here) are starting to integrate RWA utilities.

RWA and Ethereum’s Upgrades

Ethereum’s scalability upgrades, such as EIP-4844, are essential in making RWA platforms fast and cost-efficient. Additionally, Layer 3 blockchain technologies could supercharge RWA infrastructure by reducing latency and improving throughput.

Investing in RWA Tokens

Looking to invest in the next big thing? Consider adding RWA-focused tokens to your portfolio alongside top micro-cap crypto projects, AI trading bots, and crypto launchpad gems.

Future Outlook: RWA and DeFi Convergence

The convergence of RWAs with DeFi protocols opens the door to:

- New stable yield-generating strategies (Check out best yield farming pairs)

- Cross-chain trading and borrowing using tokenized RWAs (See Cross-Chain Opportunities)

- Institutional DeFi and compliance-friendly platforms (Learn about Anchorage Crypto.)

Final Thoughts

Real World Asset (RWA) tokenization in blockchain is more than a buzzword—it’s a structural shift that could redefine global finance. With blockchain innovations accelerating, RWA is poised to unlock trillions in untapped value. Keep an eye on RWA integration with emerging altcoins, DeFi automation, and crypto portfolio strategies.

If you’re serious about future-proofing your crypto portfolio, RWA tokens should not be overlooked.

Frequently Asked Questions (FAQs)

1. What are Real World Assets (RWAs) in blockchain?

Real World Assets refer to physical assets like real estate, commodities, or artwork that are digitally represented on a blockchain through tokenization, enabling secure, verifiable ownership and trading.

2. How does RWA tokenization work?

Tokenization involves creating digital tokens on a blockchain that represent ownership of a real-world asset. These tokens can be traded, fractionally owned, or used in DeFi platforms.

3. What are the benefits of tokenizing RWAs?

Benefits include increased liquidity, fractional ownership, transparency, 24/7 trading, reduced transaction costs, and easier access to global investors.

4. Are tokenized RWAs legally recognized?

Legal recognition of tokenized RWAs depends on jurisdiction. Many countries are updating regulations to provide legal clarity, but investors should check local compliance requirements.

5. Which blockchains are commonly used for RWA tokenization?

Ethereum, Polygon, Avalanche, and Polkadot are popular platforms due to their smart contract capabilities and growing DeFi ecosystems.