Mining vs Staking: Which is Better for Crypto Rewards?, Did you know the global crypto mining industry is set to grow by 29% each year? It’s expected to hit a market value of $5.2 billion by 2026. Crypto fans are now deciding between mining, staking, or both to earn rewards. This article will explore the details of these methods. It aims to help you choose the best option for your investment and interests

Key Takeaways

- Cryptocurrency mining and staking are two popular methods for earning rewards in the digital asset ecosystem.

- Mining uses powerful computers to check transactions and keep the network safe. Staking, on the other hand, requires locking up your crypto to validate transactions.

- Each method has its pros and cons, like energy use, how spread out it is, and how much money you can make.

- Deciding between mining and staking depends on your goals, tech skills, and how you feel about the environment.

- Learning about both methods will help you pick the best one for your crypto investment plan.

Understanding the Fundamentals of Crypto Mining

Crypto mining is key to the blockchain technology behind many digital currencies. It uses powerful hardware to check and add transactions to the blockchain. This is done through a process called Proof of Work (PoW). By learning about mining processes and mining hardware, we can understand how the crypto world works.

What is Proof of Work?

Proof of Work is a way to agree on new transactions in the blockchain. Miners solve hard math problems to validate these transactions. This makes the network secure and fair. The first miner to solve the problem gets cryptocurrency as a reward.

Mining Processes and Hardware Requirements

The mining processes include several steps:

- Gathering and checking new transactions

- Mixing these transactions into a block

- Solving a complex math problem for the block

- Adding the block to the blockchain

To do these tasks, miners use special mining hardware. This includes powerful GPUs or ASICs made for the job. These devices are great at solving the math problems needed for mining.

“Crypto mining is the backbone of the blockchain technology that powers various digital currencies.”

The type of mining hardware matters a lot for mining success. Miners must think about power use, speed, and cost when picking equipment. This helps them make the best choice for their mining setup.

Exploring the World of Staking

Crypto mining uses a lot of energy, but staking is a greener choice. Proof of Stake (PoS) is a way where people use their cryptocurrency to help the network. They lock up their coins to make sure transactions are secure and get rewards. This is better for the planet than mining.

Procedure for Staking:

- Choose a Staking Platform: Select a reliable platform or wallet that supports staking for your cryptocurrency.

- Buy Staking Coins: Acquire the specific cryptocurrency that allows staking (e.g., Ethereum, Cardano, TRON etc.).

- Transfer Coins to a Staking Wallet: Move your coins to a wallet that supports staking, or directly stake on the platform.

- Select a Validator/Delegate: If required, choose a validator or staking pool to delegate your coins. Ensure the validator has a good reputation.

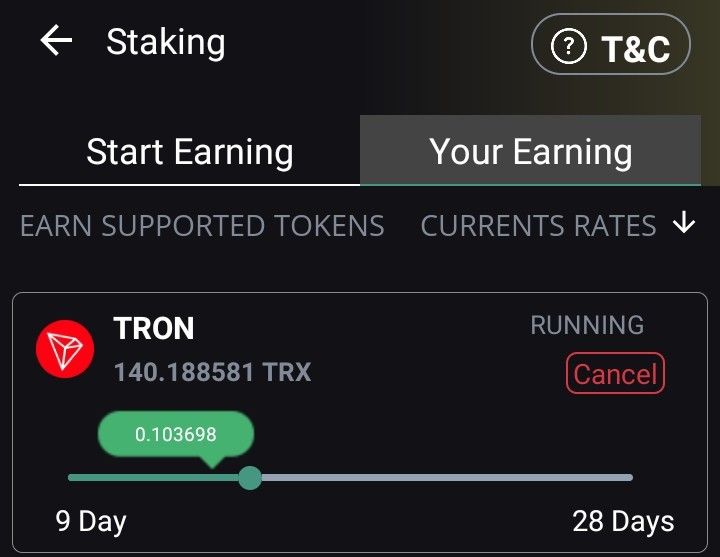

- Initiate Staking: Start the staking process by locking your coins into the network for a specific period. Follow the platform’s instructions for confirmation.

- Earn Rewards: As your coins participate in securing the network, you will earn staking rewards periodically.

- Unstaking: When you wish to withdraw your coins, follow the unstaking process. There may be a waiting period before you can access your funds.

Always check fees, rewards, and minimum staking amounts for each platform.

Proof of Stake: A Greener Alternative

In PoS, people who own cryptocurrency can stake their coins. This means they lock up their digital money for a while. During this time, they can earn rewards for checking transactions and keeping the blockchain safe. Staking doesn’t need special hardware or a lot of energy, making it a better choice for the environment.

- Staking lets users help run the network and earn rewards based on how much they stake.

- The staking requirements differ by cryptocurrency, but you usually need a certain amount of the asset to stake.

- The rewards from staking can be used to grow your cryptocurrency or put back into the network.

Using Proof of Stake helps cryptocurrency projects lessen their environmental impact. It keeps the blockchain secure and trustworthy. This shift to a greener option is becoming popular in the crypto world. More people see the advantages of staking over mining.

Energy Consumption: Mining vs Staking

The debate between mining and staking often focuses on energy use. Mining uses a lot of energy because it needs powerful computers. Staking, on the other hand, is better for the environment.

Mining uses a lot of energy because it needs high-performance hardware. This hardware solves complex math problems. Staking, however, uses less energy and doesn’t need as much computing power.

| Metric | Mining | Staking |

|---|---|---|

| Energy Consumption | High | Low |

| Hardware Requirements | Powerful computing hardware | Minimal computational resources |

| Environmental Impact | Significant carbon footprint | Reduced environmental impact |

Now, people are paying more attention to how industries affect the environment. Staking is seen as a better choice because it uses less energy. This makes it appealing to those who care about the planet.

“Staking is a more energy-efficient way to validate transactions and earn rewards, compared to the high energy demands of mining.”

Even though mining is still important, more people are looking at staking as a way to earn crypto that’s better for the planet. This shift is because of a growing focus on being sustainable and responsible.

Decentralization and Network Security

Cryptocurrency networks use a decentralized way to stay secure and strong. Miners and stakers are key to keeping the blockchain safe. They check transactions, make sure the ledger is correct, and stop anyone from changing the system.

The Role of Miners and Stakers

Miners are crucial in proof-of-work blockchains like Bitcoin. They use powerful computers to solve hard math problems, called “mining.” When they mine a block, they add new transactions to the blockchain and get new cryptocurrency as a reward. This keeps the network spread out, so no one can control it.

Proof-of-stake networks, like Ethereum 2.0, use stakers instead. Stakers put some of their cryptocurrency on the line to help validate transactions and add blocks. They get to earn rewards this way. This method uses less energy but still keeps the network safe.

| Miners | Stakers |

|---|---|

| Verify transactions in proof-of-work networks | Validate transactions in proof-of-stake networks |

| Receive rewards in the form of newly minted cryptocurrency | Earn rewards based on their staked holdings |

| Contribute to the decentralization of the network | Help maintain network security and integrity |

Miners and stakers are vital for keeping cryptocurrency blockchains safe and trustworthy. Their work helps these new financial systems stay strong and reliable.

mining vs staking which is better?

The debate on mining and staking in the crypto world is ongoing. Both have their pros and cons. It’s important to think about what you want from your investment before choosing.

Mining uses the Proof of Work (PoW) method. Miners solve complex math problems to validate transactions and add blocks to the blockchain. Staking uses Proof of Stake (PoS), where you stake your crypto to validate transactions and earn rewards.

Energy Efficiency and Environmental Impact

Staking is better for the environment because it uses less energy. Proof of Stake is more energy-efficient than Proof of Work mining. This is good news for those worried about the environmental effects of crypto.

Barriers to Entry and Decentralization

Mining can be hard for individuals because it needs special hardware and a lot of electricity. Staking is easier, needing less money and just your crypto. This makes staking more open to everyone, helping the network be more decentralized.

Rewards and Risks

Both mining and staking offer rewards, but they’re different. Mining rewards can change a lot, depending on mining difficulty and market prices. Staking rewards are more stable but might be lower. Staking also means you might not have access to your funds for a while.

Choosing between mining and staking depends on what you want and what you can do. Think about your goals and make a choice that fits your crypto plan.

“The choice between mining and staking is not a one-size-fits-all decision. It’s essential to weigh the unique advantages and drawbacks of each approach to determine which aligns best with your crypto investment goals.”

Profitability Considerations

Both mining and staking offer ways to earn rewards in the crypto world. It’s important to know about mining rewards and costs, as well as staking rewards and requirements. This knowledge helps you decide which method is best for you.

Mining Rewards and Costs

Crypto mining can be profitable, with miners earning a part of new coins for verifying transactions. But, mining comes with big costs like hardware, electricity, and cooling. The success of mining depends on the coin’s market price, the mining gear’s efficiency, and the costs to run it.

Staking Rewards and Requirements

Staking is a way to earn rewards without much effort. You hold a certain amount of crypto in a wallet and help validate the network. The rewards for staking can be good, but you need to meet the minimum requirements. These requirements differ among cryptocurrencies, so check them before you start.

| Metric | Mining | Staking |

|---|---|---|

| Rewards | Percentage of newly minted coins | Percentage of newly minted coins |

| Costs | Hardware, electricity, cooling | Minimum staking requirements |

| Profitability | Depends on market price, hardware efficiency, and operating costs | Depends on staking requirements and rewards |

Think carefully about the rewards, costs, and requirements of mining and staking. This will help you pick the best option for your financial goals and how much risk you can take. Whether you mine or stake, keep up with crypto trends to earn more.

Cryptocurrency Platforms for Mining vs Staking

In the world of cryptocurrency, many platforms offer chances for mining and staking. These platforms give users the tools to help secure blockchain networks. Users earn rewards for their efforts.

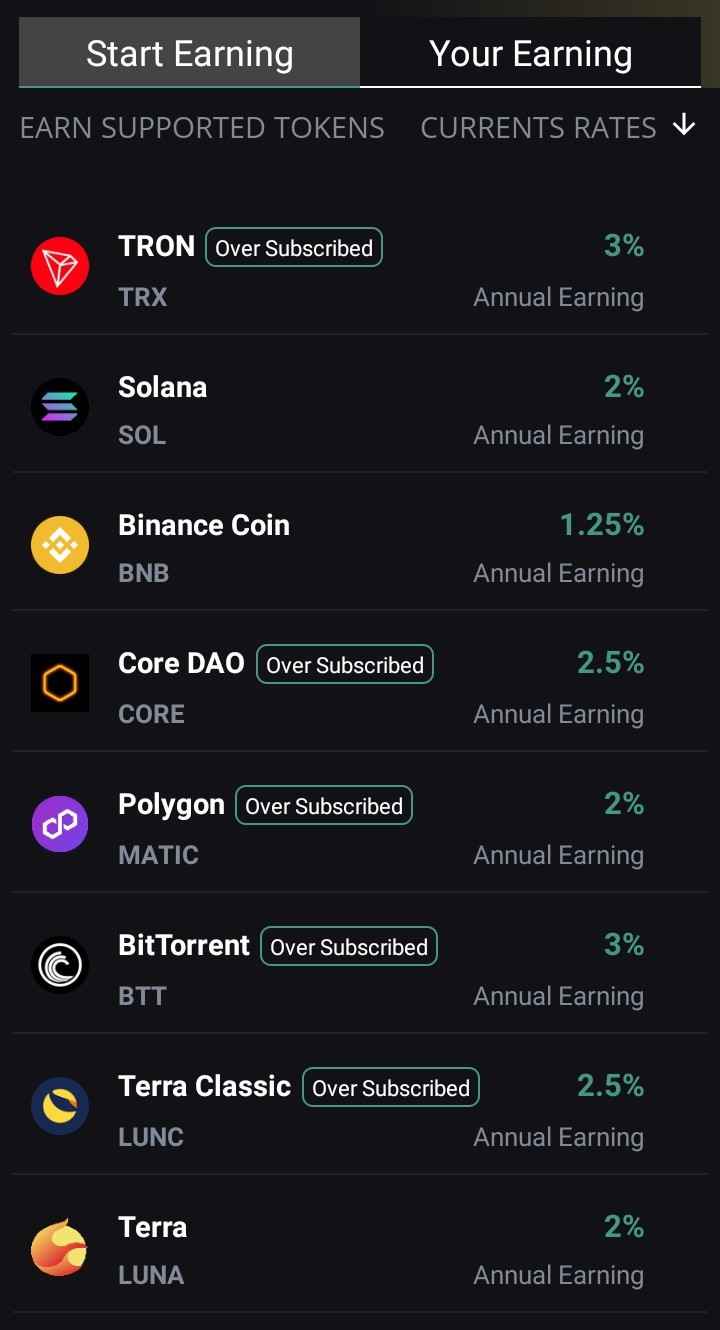

For cryptocurrency mining platforms, Binance, Ethereum, and Solana are top choices. They have advanced mining rigs and easy-to-use interfaces. This makes mining easier for both new and experienced users.

Crypto staking platforms like SunCrypto, Coinbase, Kraken, and Celsius Network are great for earning passive income. Users can lock up their crypto and help secure the network. In return, they get rewards.

When picking a platform, look at the staking rewards it offers. Solana and Polkadot give staking rewards of up to 2rewards% or more. This makes them a good choice for those wanting high returns. Here are some annual earning reward are given below

“Staking can be a great way to earn passive income and support the network, but it’s important to do your research and choose a platform that aligns with your investment goals.”

The best platform for you depends on your investment strategy and risk level. Look at the features and rewards each platform offers. This way, you can make a smart choice and explore new opportunities in cryptocurrency.

The Future of Mining vs Staking

The world of cryptocurrency is always changing, and so is the future of mining and staking. New trends and innovations are changing how we earn crypto rewards.

Trends in Mining vs Staking

The future of mining looks bright with better hardware and ways to save energy. Miners might use more efficient ASIC chips. This means they can work faster and use less power. Plus, using solar and wind energy could make mining greener.

For staking, the future is looking bright too. More crypto projects are using Proof of Stake (PoS). This means more people can join in and earn rewards. We might see easy-to-use platforms for beginners to start staking.

Innovations in Mining vs Staking

- New mining hardware, like better ASIC chips, will bring more innovation to mining.

- Using solar and wind power in mining can cut down on carbon emissions and make mining greener.

- DeFi protocols are looking into staking as a way to earn money, which could lead to more staking innovations.

- Technologies like quantum computing and advanced cryptography might change mining and staking in the future, offering both challenges and chances.

The future of mining and staking will be shaped by these new trends and innovations. People interested in cryptocurrency should keep up with these changes. This way, they can make smart choices about joining the crypto world.

Factors to Consider When Choosing Between Mining and Staking

Choosing between crypto mining and staking is a big decision. You need to think about what you want and what you can do. Let’s look at the main things to think about when deciding between mining vs. staking.

Investment Objectives

First, think about what you want to achieve with your investment. Do you want quick profits, steady income, or a mix of both? Mining can give you big rewards quickly but needs a lot of money for equipment and power. Staking offers steady income with less money upfront.

Technical Expertise for Mining vs Staking

Think about how tech-savvy you are. Mining needs you to manage mining rigs, fix problems, and adjust settings. Staking is easier, needing less tech skill. Many platforms make staking simple for users.

Available Resources for Mining vs Staking

Look at what you have, like money, computing power, and cheap electricity. Mining requires a lot of money for good equipment and reliable power. Staking needs less money and less power.

Risk Tolerance for Mining vs Staking

Think about how much risk you can handle. Mining is risky because rewards change with the market and competition. Staking is more stable but may give lower rewards.

Choosing between mining and staking depends on your situation and what you like. Think about these factors to make a choice that fits your investment goals and handles the mining vs. staking balance.

| Factors | Mining | Staking |

|---|---|---|

| Investment Objectives | Short-term rewards | Long-term passive income |

| Technical Expertise | Higher technical requirements | Lower technical requirements |

| Available Resources | Requires significant upfront investment in hardware and energy | Lower initial outlay and energy consumption |

| Risk Tolerance | Higher volatility in rewards | More stable and predictable rewards |

Security and Regulatory Landscape

The crypto industry is always changing, making security and rules more important. People into crypto must deal with risks and new rules to keep their investments safe and right.

Addressing Concerns and Challenges

Security is a big worry in crypto, especially for mining and staking. Mining security is key because miners check transactions and keep the blockchain safe. If mining gear or software has flaws, it could cause big problems like double-spending or network issues. Staking security is also vital, as stakers help check transactions and keep the network safe.

The rules for crypto regulations, mining regulations, and staking regulations are always changing. This can be tough for crypto users, as laws at the national and global levels aim to balance innovation with protecting consumers.

| Concern | Mining | Staking |

|---|---|---|

| Security | Vulnerabilities in mining hardware or software | Risks associated with staking wallets and infrastructure |

| Regulations | Compliance with mining regulations | Adherence to staking regulations |

To tackle these issues, crypto fans need to keep up with the latest on security and rules. By knowing the risks and acting early, they can feel more secure when mining and staking.

“The security and regulatory landscape of the crypto industry is constantly shifting, requiring vigilance and adaptability from all participants.”

Conclusion of Mining vs Staking

The debate between mining and staking in cryptocurrency is very interesting. Both methods have their own benefits and suit different investment styles and risk levels. The choice between mining and staking depends on your goals, resources, and what you prefer.

Do you like the challenge of mining or the easy income of staking? It’s important to know the basics, understand the main differences, and think about various factors. This helps you make a smart choice. By looking at energy use, how decentralized it is, and profits, you can make a better decision.

The world of crypto is always changing, with new tech in mining and staking. Keeping up with these changes can help you adjust your strategy and find new chances. Remember, your crypto journey is special. The best path for you will match your investment goals and how much risk you can take.

FAQ releted for Mining vs Staking

What is the difference between mining and staking in cryptocurrency?

Mining and staking are two ways to validate transactions on a blockchain. Mining uses powerful hardware to solve math problems. Staking means locking up your crypto to help validate transactions.

What is Proof of Work (PoW) and how does it work in crypto mining?

Proof of Work (PoW) is the method used in mining. Miners compete to solve math problems to validate transactions. The first one to solve gets rewarded with crypto for their work.

What are the hardware requirements for cryptocurrency mining?

Mining needs special hardware like ASICs or GPUs to solve math problems. The exact hardware needed depends on the crypto being mined.

What is Proof of Stake (PoS) and how does it work in crypto staking?

Proof of Stake (PoS) is for crypto staking. Instead of solving problems, stakers lock up their crypto to help validate transactions. They get rewarded with more crypto based on how much they staked and for how long.

How does the energy consumption of mining differ from staking?

Mining uses more energy than staking because it needs a lot of computing power. Staking is seen as more energy-efficient since it doesn’t need as much power.

How do mining and staking contribute to the decentralization and security of a blockchain network?

Mining and staking are key to keeping a blockchain secure and decentralized. They verify transactions and keep the network honest. Having many miners and stakers helps prevent one person from controlling the network.

Which is better, mining or staking, for earning crypto rewards?

Whether mining or staking is better depends on your goals and what you have. Both can earn you rewards, but the specifics vary by crypto and platform.

What are the potential rewards and costs associated with mining and staking?

Rewards for mining and staking depend on the crypto, network activity, and your setup. Mining rewards come from validating transactions. Staking rewards depend on how much crypto you hold and for how long. Both have their costs, like mining hardware or the cost of staking your crypto.

Which crypto platforms offer the best staking rewards?

Many platforms offer staking, each with different rewards and features. Top platforms for staking rewards include Ethereum, Cardano, Polkadot, and Cosmos. It’s smart to compare these platforms to find the best fit for you.

What are the most rewarding crypto mining options?

The best mining options depend on the crypto, mining difficulty, energy costs, and competition. Cryptos like Bitcoin, Ethereum, Litecoin, and Monero are often profitable. But, check the mining needs and costs for each crypto to see what’s best for you.

Where can I earn the best rewards on my cryptocurrency?

The best place to earn rewards depends on the crypto, platform, and earning method. Research and compare options across different platforms and cryptos to find the most rewarding one for your goals and risk level.