The Aave liquidity mining program is a pivotal initiative within the decentralized finance (DeFi) ecosystem. It offers users the opportunity to earn rewards by supplying or borrowing assets on the Aave platform. This incentive program has significantly contributed to the platform’s growth, attracting liquidity providers and traders seeking passive income opportunities.

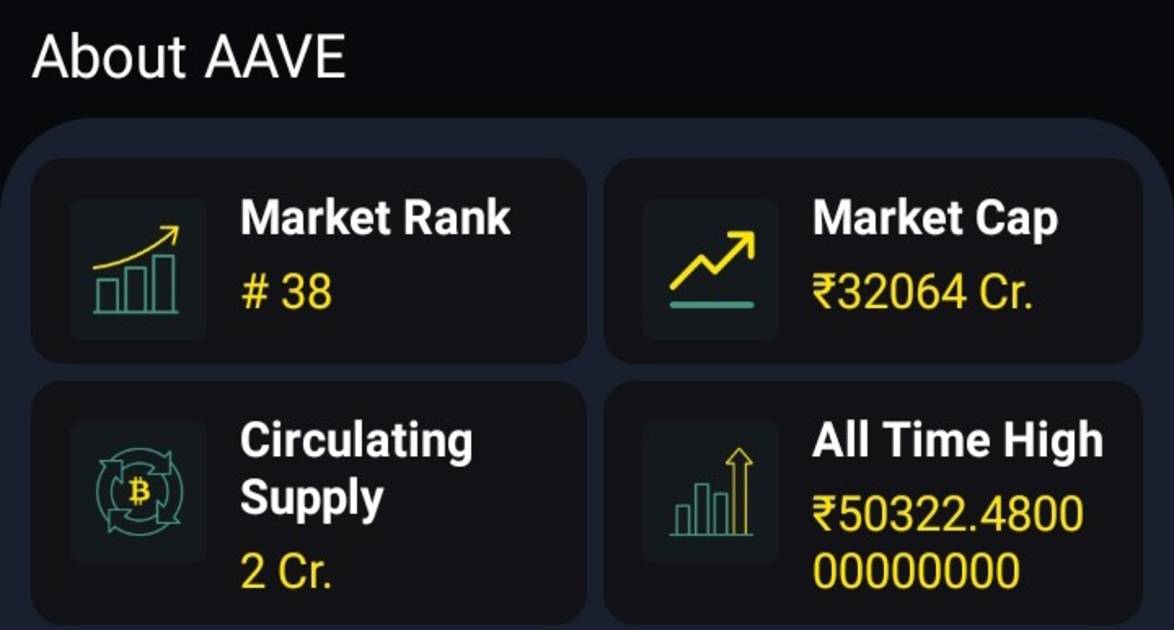

What is Aave?

AAVE is a leading decentralized lending and borrowing platform that enables users to earn interest on their deposits while facilitating loans without intermediaries. It operates through smart contracts, ensuring transparency, security, and efficiency. The liquidity mining program further enhances Aave’s appeal by rewarding participants with governance tokens.

How the Aave Liquidity Mining Program Works

The liquidity mining program incentivizes users to supply or borrow assets by distributing AAVE tokens as rewards. Here’s how it works:

- Supply Liquidity: Users deposit supported cryptocurrencies into Aave’s liquidity pools.

- Borrowing Incentives: Borrowers also receive liquidity mining rewards, encouraging borrowing activity.

- Automated Distribution: Smart contracts automatically distribute AAVE rewards based on user participation.

Benefits of Aave Liquidity Mining

- Attractive Rewards: Users earn AAVE tokens in addition to regular yields from lending.

- Decentralization & Security: Aave’s protocol is highly secure, audited, and community-driven.

- Flexible Earning Opportunities: Both suppliers and borrowers can benefit from the program.

- Governance Participation: AAVE token holders can participate in governance decisions, influencing platform upgrades and changes.

Why Choose AAVE for Liquidity Mining?

- Diverse Asset Support: Aave supports a wide range of cryptocurrencies, increasing flexibility for yield farmers.

- Proven Track Record: As one of the most trusted DeFi platforms, Aave has established itself as a leader in decentralized lending.

- Sustainable Growth: The liquidity mining program aligns with Aave’s long-term vision of fostering a self-sustaining DeFi ecosystem.

Conclusion

The Aave liquidity mining program is an excellent opportunity for users to earn passive income while contributing to the DeFi ecosystem. By supplying or borrowing assets, participants can maximize their rewards and engage in governance. As Aave continues to innovate, its liquidity mining incentives remain a crucial factor in its expanding user base. For more insights on Ethereum investment strategies, check out our detailed guide on Ethereum investment strategies.