In today’s fast-evolving digital landscape, blockchain analytics has become a cornerstone for businesses and financial institutions. By harnessing the power of blockchain data, companies can gain crucial insights into transaction patterns, ensure compliance with regulatory frameworks, and detect fraudulent activities, making it a vital tool in the modern financial ecosystem. Furthermore, blockchain analytics is paving the way for innovation across sectors like the metaverse and cryptocurrency virtual economies in 2024.

What is blockchain analytics?

Blockchain analytics refers to the process of examining and interpreting the vast amounts of data generated by blockchain networks. By scrutinizing transaction histories, wallet addresses, and smart contract interactions, analysts can uncover valuable insights and trends. This specialized field utilizes advanced tools and methodologies to help businesses, regulators, and researchers understand the intricacies of blockchain ecosystems, driving better decision-making and strategy formulation. As cross-chain technology continues to evolve, blockchain analytics also plays a critical role in ensuring seamless crypto transfers across different blockchain networks.

The Scope of Blockchain Analytics

At its core, blockchain analytics focuses on deriving actionable insights from blockchain data. Its applications span various domains, from financial transactions and supply chain management to digital identity verification. With blockchain analytics, organizations can get a granular view of activities within the network, identifying key players, tracking asset transfers, and ensuring compliance. This comprehensive understanding is indispensable for anyone looking to leverage the power of blockchain technology effectively. including the Web3 integration bridging blockchain and Internet 3.0.

How Does Blockchain Analytics Work?

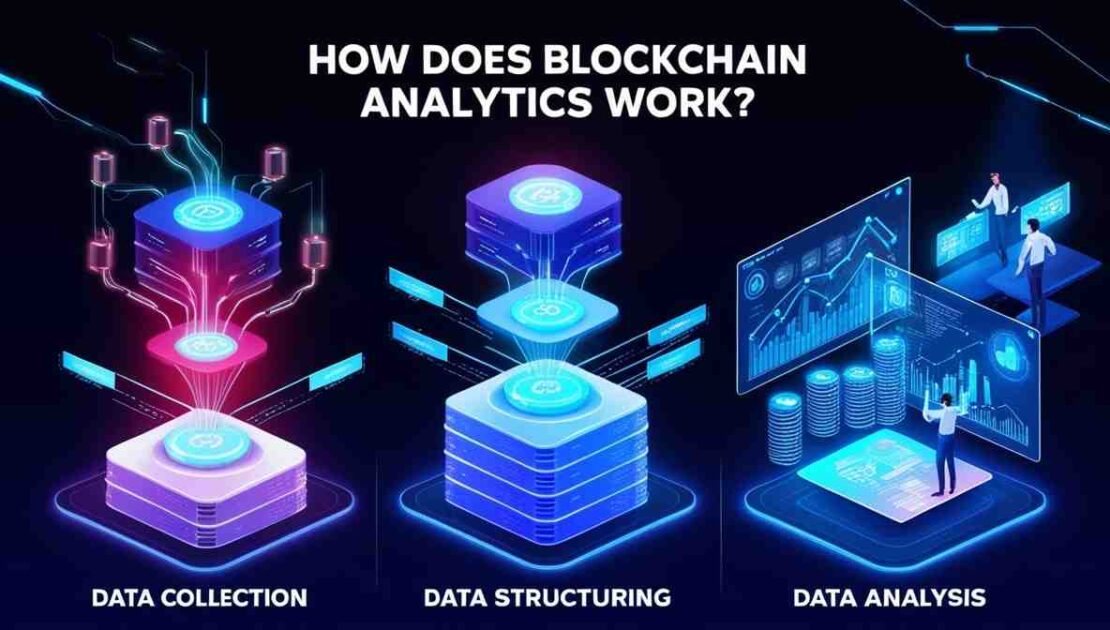

Blockchain analytics follows a multi-step process to ensure that data is effectively collected, processed, and analyzed. Here’s a closer look at how it works

- Data Collection: Raw data from blockchain networks is gathered, including transaction details, wallet addresses, and metadata from smart contracts. Tools like blockchain explorers and APIs play a significant role in this phase.

- Data Structuring: Once the raw data is collected, it undergoes structuring and normalization to ensure it is suitable for analysis. This process makes the data consistent and accurate, allowing for meaningful interpretation.

- Data Analysis: Analysts employ various techniques, such as statistical analysis, machine learning, and heuristic methods, to uncover trends, patterns, and anomalies within the blockchain network. Visualization tools also help present the data in a comprehensible format, aiding in strategic decision-making.

Leading Blockchain Analytics Platforms

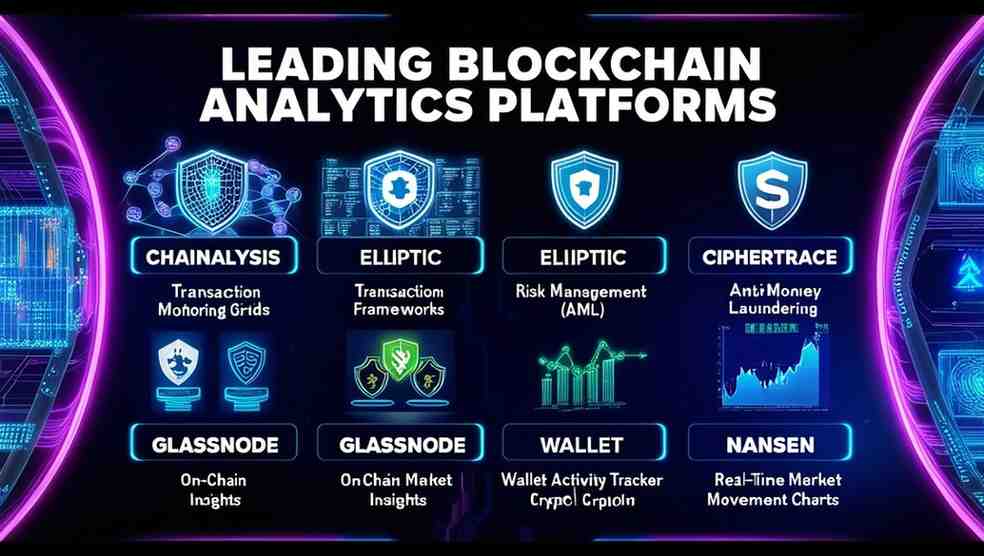

Several key players dominate the blockchain analytics industry, providing advanced solutions for data analysis, regulatory compliance, and fraud detection:

- Chainalysis: A leading provider of blockchain analytics tools, Chainalysis specializes in monitoring and investigating blockchain transactions. Their tools are widely used by law enforcement and financial institutions for regulatory compliance and fraud detection.

- Elliptic: Known for its robust risk management and analytics solutions, Elliptic helps businesses comply with regulations while detecting illicit activities within blockchain ecosystems.

- CipherTrace: Focusing on cryptocurrency intelligence and blockchain security, CipherTrace provides anti-money laundering (AML) solutions and helps prevent fraud.

- Glassnode: A platform offering comprehensive on-chain market insights, Glassnode’s tools are essential for traders and researchers aiming to understand blockchain trends and activities.

- Nansen: This platform combines on-chain data with a user-friendly interface, enabling users to track transactions, wallet activity, and market movements, thus providing crucial insights into blockchain behavior.

Key Methodologies in Blockchain Analytics

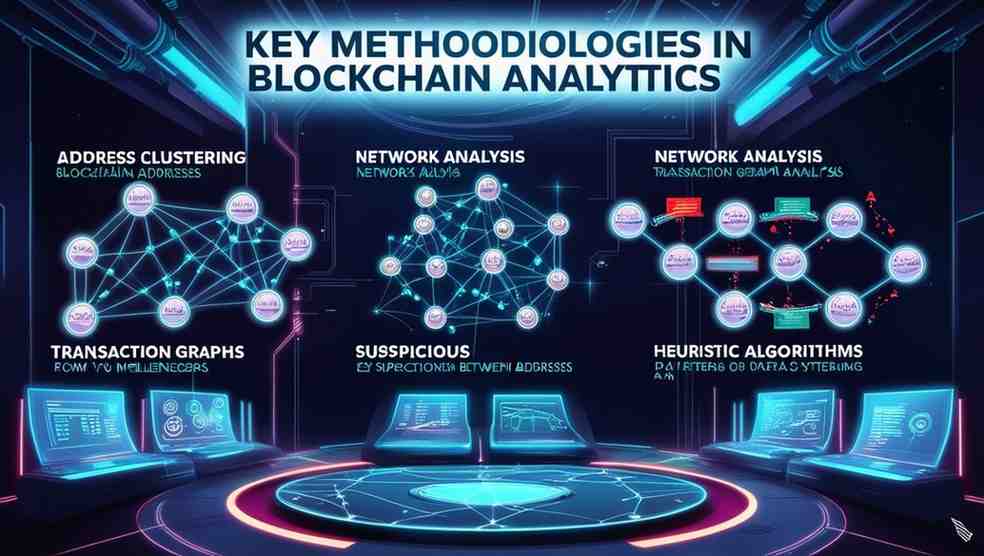

Blockchain analytics utilizes various methodologies to extract valuable insights from complex blockchain data.

- Address Clustering: This technique groups blockchain addresses controlled by the same entity, helping analysts identify key stakeholders or malicious actors based on transaction patterns.

- Network Analysis: By visualizing the flow of transactions within a blockchain, network analysis helps in understanding how assets move and identifies influential nodes and connections within the network.

- Transaction Graph Analysis: Transaction graphs visually represent the relationships between different addresses, helping analysts detect suspicious activities like money laundering or illicit fund transfers.

- Heuristic Algorithms: These algorithms are designed to flag unusual or suspicious activity, such as sudden large transfers from dormant addresses, helping prevent fraud and money laundering. Techniques like these are critical when analyzing price discrepancies and profiting from crypto arbitrage trading.

Tools for Blockchain Analysis

These tools are essential for businesses, law enforcement, and financial institutions. Here’s a look at some of the most widely-used tools:

- Chainalysis Reactor: This tool offers advanced features such as address clustering and transaction flow analysis. Making it ideal for tracking illicit activities and ensuring regulatory compliance.

- Elliptic Navigator: A real-time blockchain transaction monitoring tool. Elliptic Navigator screens transactions against a comprehensive risk dataset. Helping businesses mitigate risks and comply with regulations.

- Nansen: This platform combines on-chain data with a user-friendly interface. Enabling users to track transactions, wallet activity, and market movements, thus providing crucial insights into blockchain behavior. As more innovations like Layer-2 Meme Coins emerge, analytics platforms become increasingly vital for navigating the dynamic crypto markets.

Conclusion

Blockchain analytics is becoming an indispensable tool for businesses and regulators alike. Providing the necessary insights to navigate the complex world of blockchain technology. With the ability to track transactions, detect fraud, and ensure compliance. Blockchain analytics offers a clear path for companies to leverage blockchain’s full potential. While maintaining a secure and transparent digital environment. As the technology continues to evolve, solutions like blockchain scalability and innovations. Such as DePIN are set to revolutionize the way we approach blockchain ecosystems.

FAQs

What is the market insight of blockchain?

Blockchain market insights reveal trends like growing adoption across industries, advancements in decentralized finance (DeFi), and increasing use in supply chain management and digital assets. These insights help businesses understand blockchain’s impact on security, transparency, and efficiency.

What is blockchain data analytics?

Blockchain data analytics involves collecting, processing, and analyzing blockchain data to identify patterns, trends, and anomalies. It helps in areas like compliance, fraud detection, and gaining insights into transaction behaviors.

Why is blockchain analysis important?

Blockchain analysis is crucial for ensuring transparency, regulatory compliance, detecting fraud, and identifying transaction patterns. It enables better decision-making in financial systems, cryptocurrency markets, and other blockchain-based applications.

What is the relationship between blockchain and marketing?

Blockchain enhances marketing by improving data transparency, enhancing customer trust, and enabling secure, verifiable transactions. It allows marketers to use analytics for better audience targeting, loyalty programs, and digital ad tracking